Get the Facts

What is Long-Term Services and Supports (LTSS)?

Long-term services and supports (LTSS) provide aging adults and adults with disabilities the support they need to live independently, including help with personal care, medical assistance, transportation, meals, and more.

70% of Washingtonians over the age of 65 will require some type of LTSS. The average lifetime cost of LTSS for those turning 65 today is $260,000, far more than many families have saved.

The Challenge

Our Older Population is Increasing

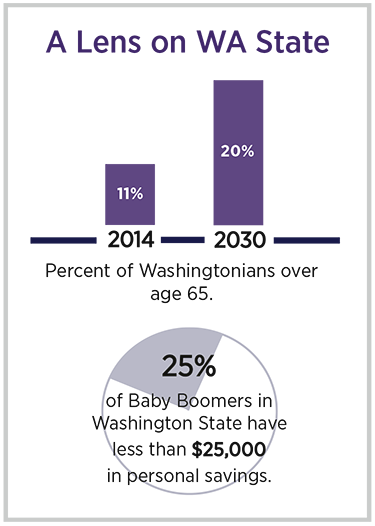

- According to the U.S. Census, the older population (65 years and above) is set to double by 2030.

- Over 60,000 Washingtonians rely on long-term services and supports (LTSS). This need is projected to nearly double by the year 2040.

Our LTSS Insurance Market is Broken

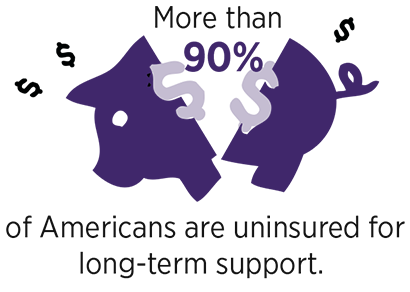

- Over 90% of seniors are uninsured for LTSS – plans are too expensive for most individuals, and those with pre-existing conditions can be denied coverage.

- Neither traditional health insurance nor Medicare pay for LTSS.

- Most seniors must spend their lifesavings down to poverty in order to qualify for Medicaid LTSS coverage.

The Number of Unpaid Family Caregivers is Shrinking

- The state’s 830,000 unpaid family caregivers provide about $10.7 billion worth of care annually.

- Due to demographic changes, the supply of potential family caregivers is projected to decrease by 43% by 2030.

Our Medicaid Budget is Already Strained

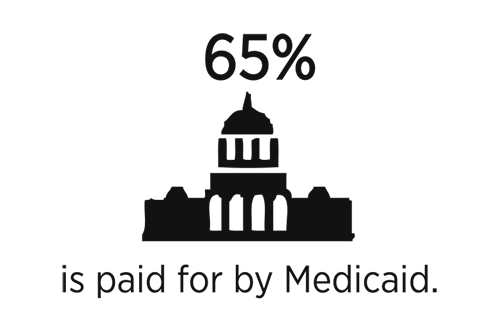

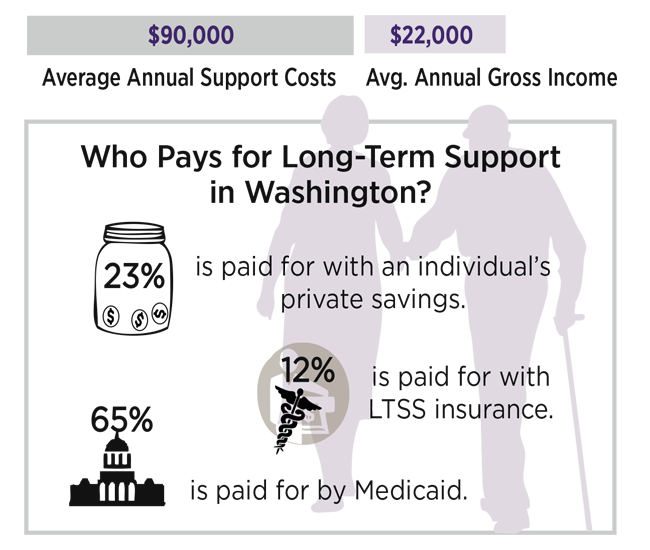

- 65% of all LTSS costs are paid for by Medicaid.

- Medicaid LTSS currently makes up 6% of Washington’s budget and is projected to double by 2030.

The Solution

Long-Term Care Trust Act

- A public long-term care benefit that covers all workers over the age of 18.

- $36,500 lifetime benefit can be used on a vareity of services including pay for in-home care, nursing home care, and other approved long-term care services and supports like respite, a wheelchair ramp, meals on wheels or rides to the doctor.

- Benefit can be used consecutively or non-consecutively depending on your needs.

- Benefit will be financed by a 0.58% payroll deduction on all workers.

- To qualify for the benefit, workers would pay into the fund for a minimum of ten years. There is also a safeguard for unexpected crises, allowing people to use the benefit if they have paid in three of the previous six years.

- Individuals currently retired or out of the work force would not pay into the system and would not be eligible for the benefit.

Impacts of the LTC Trust Act

- The Long-Term Care Trust Act would reduce the biggest uninsured risk we now face.

- It will help protect future taxpayers from the cost, both to their families and to the state budget.

- Most of all, it would give families the security of knowing they will get the care they need when they need it most without the added stress of how to pay for it.

- Relieves strain on Medicaid budget, and will protect other budget priorities such as education spending.

- Prevents seniors from spending their life savings down to poverty to access Medicaid.

- Protects families from some of the financial impacts family caregiving duties.

- Increases business productivity by reducing the number of family caregivers who must take time off work or quit paid employment entirely.

- Provides a layer of financial protection for seniors in the face of uncertainty regarding Social Security, Medicare, and Medicaid policy.

- The private LTC insurance market is currently failing, but a new LTC Trust could spur new LTC wrap market, similar to what happened with Medicare and gap plans.

Public and Organizational Support for the LTC Trust Act

- The LTC Trust Act has broad organizational support from major senior organizations, including AARP, Adult Family Home Council, Alzheimer’s Association, Washington Health Care Association, SEIU 775, Washington Association of Area Agencies on Aging (W4A), Senior Citizens’ Lobby, LeadingAge Washington, the Long-term Care Ombudsman Program, and many others.

- A recent statewide poll found that after hearing details of the legislation 62% of likely voters support the LTC Act.

What you can do to help

- Sign-Up for updates!

- Tell us about your experience with Long-Term Care!

Long-Term Support Infographics

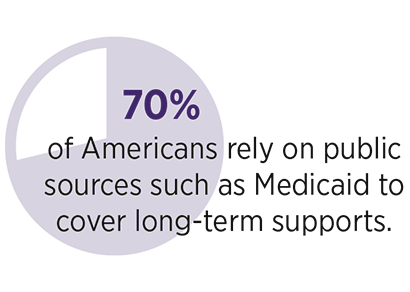

Over 12 million Americans rely on long-term services and supports. It is projected that the national over-65 population will double by the year 2040. 50% of Americans over the age of 65 will require some type of long-term support.

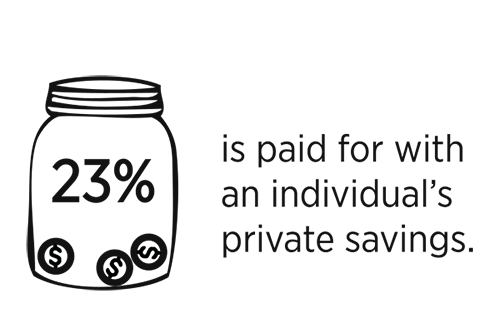

Who Pays for Long-Term Support in Washington?